Meals Reimbursement 2025

Meals Reimbursement 2025 - 2025 2025 CACFP MEAL REIMBURSEMENT RATES CENTERS, The per diem rate for fy 2025 will be $9 more than last year’s, going from $157 allowed per day to $166. Except for the metropolitan areas listed below, the maximum reimbursement for meals including tax and gratuity, shall be: 2025 Reimbursement Form Fillable, Printable PDF & Forms Handypdf, Reimbursements for lodging will be capped at $107 per. Find current rates in the continental united states, or conus rates, by searching below with.

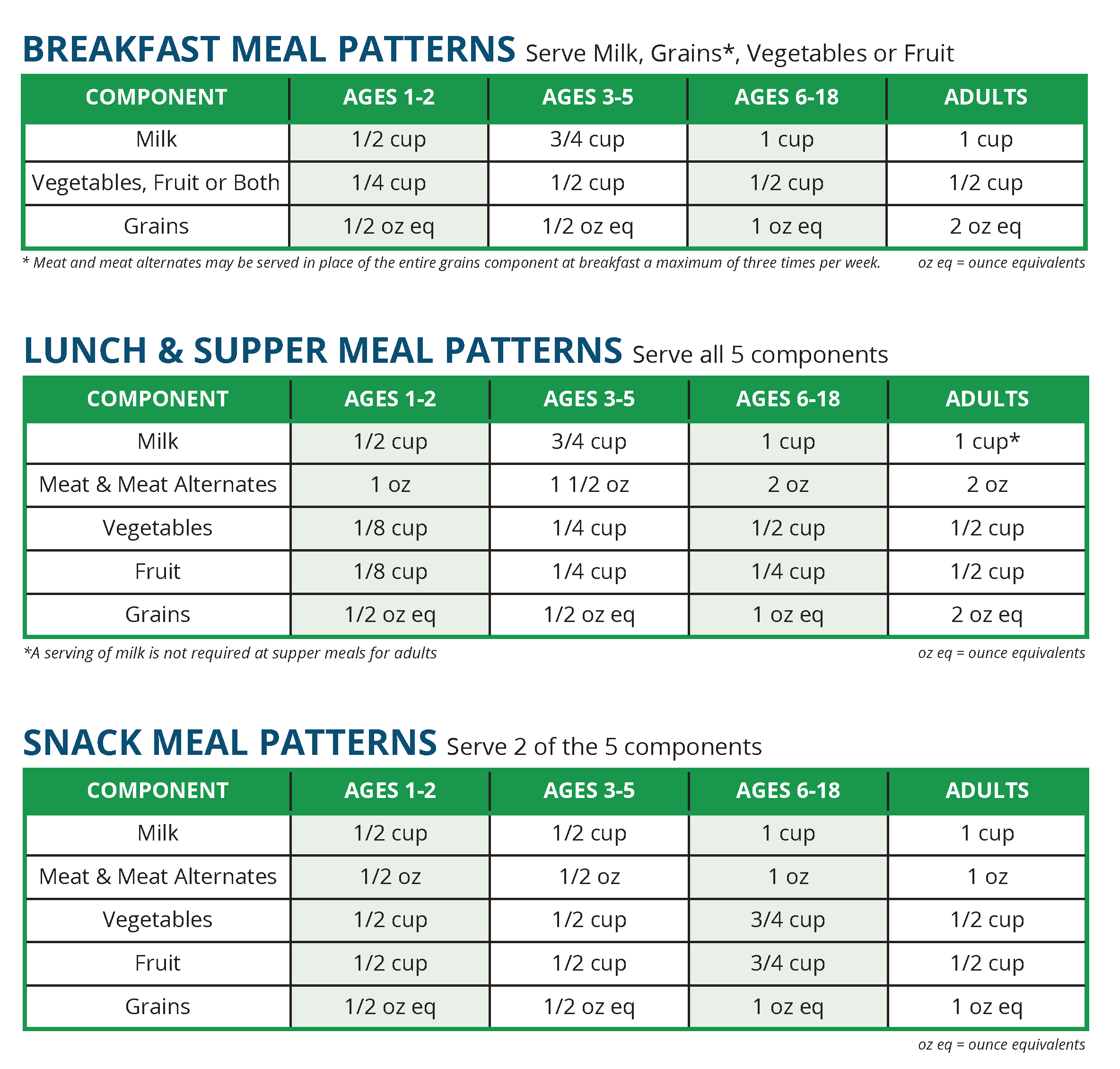

2025 2025 CACFP MEAL REIMBURSEMENT RATES CENTERS, The per diem rate for fy 2025 will be $9 more than last year’s, going from $157 allowed per day to $166. Except for the metropolitan areas listed below, the maximum reimbursement for meals including tax and gratuity, shall be:

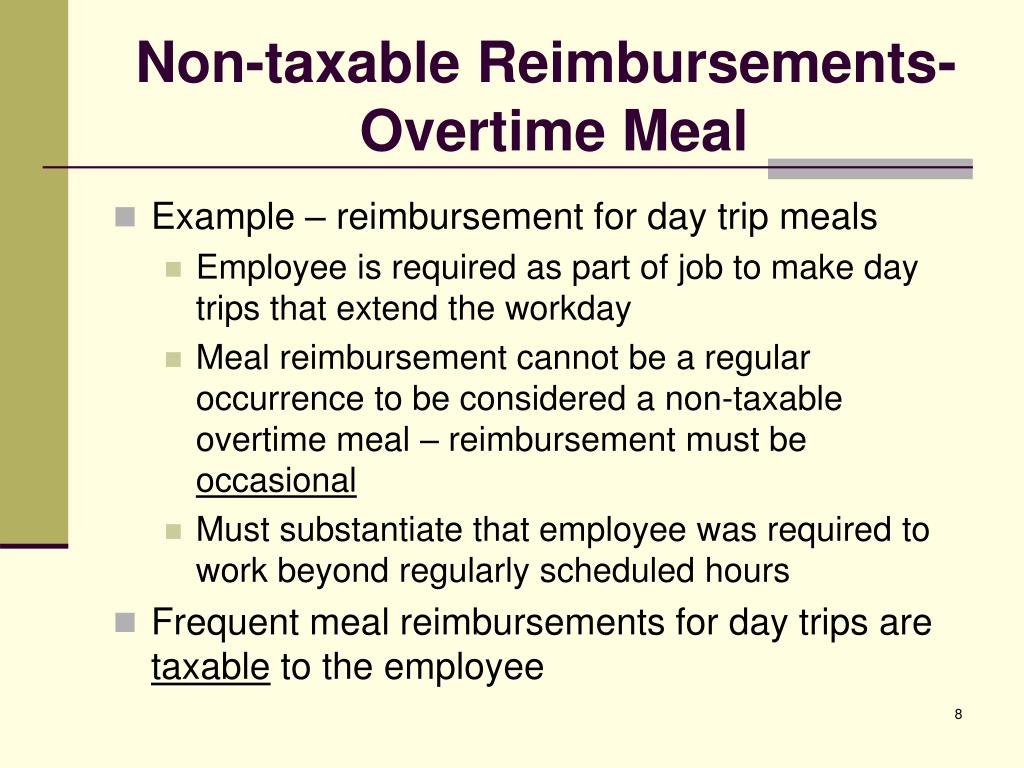

PPT Meal Reimbursements PowerPoint Presentation, free download ID, In this guide, we’ll cover everything you need to know about writing off meals: Prior to 2025, taxpayers could deduct 50% of their meal expenses incurred.

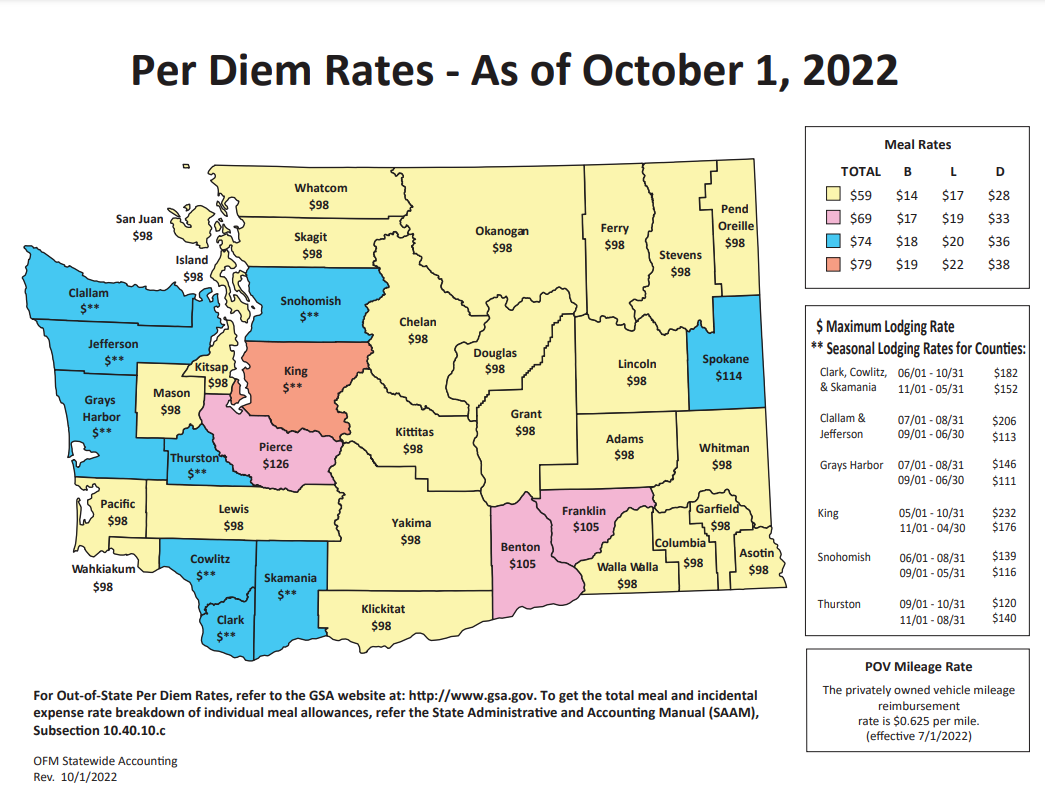

Meals Reimbursement 2025. The maximum state reimbursement rate is $59/day. Find current rates in the continental united states, or conus rates, by searching below with.

2025 2023 CACFP MEAL REIMBURSEMENT RATES CENTERS, Employers who travel outside of their tax home for business purposes and stay overnight can have their meal. The per diem rate for fy 2025 will be $9 more than last year’s, going from $157 allowed per day to $166.

Allowable meal charges and reimbursements for daily subsistence.

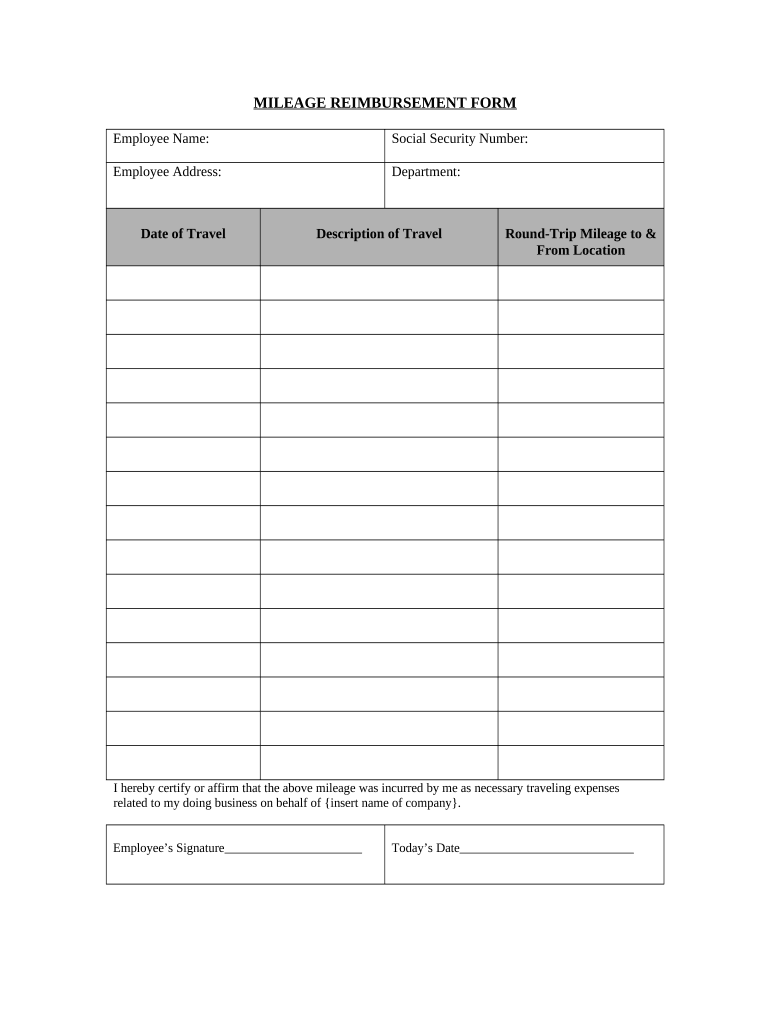

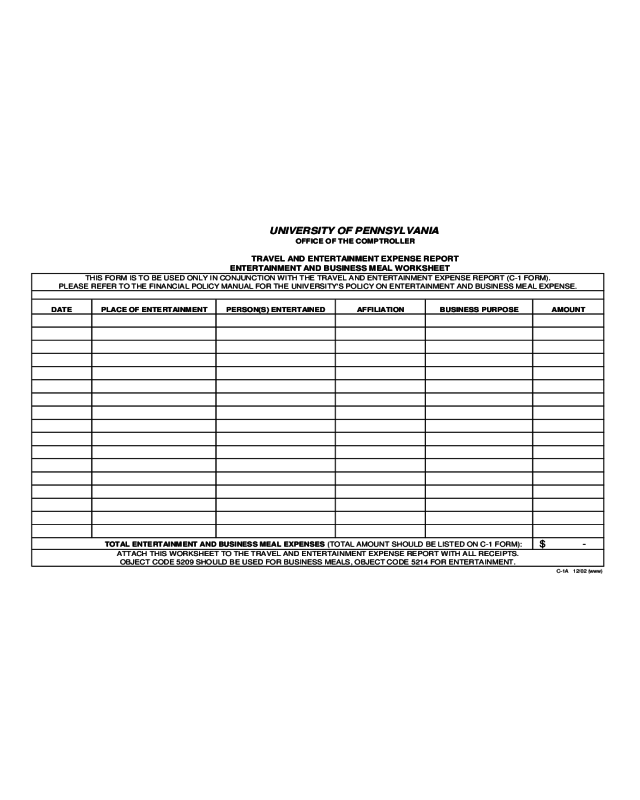

Reimbursement Form Print Fill Out and Sign Printable PDF Template, If you are reimbursed for the cost of your meals, how you apply the 50% limit depends on whether your employer's reimbursement plan was accountable or nonaccountable. Meal rates for high cost metropolitan areas.

Except for the metropolitan areas listed below, the maximum reimbursement for meals including tax and gratuity, shall be:

Irs Per Diem Rates 2025 By State Rona Carolynn, Reimbursement for meal and lodging expenses. Below are the numbers which reflect the national average payments, the amount of money the federal government provides states for lunches,.

Except for the metropolitan areas listed below, the maximum reimbursement for meals including tax and gratuity, shall be: M&ie total = breakfast + lunch + dinner + incidentals.

膳食模式指导全国CACFP赞助商协会 beplay体育安卓版, Tax treatment of meal payments and food provided (summary table) meal allowance/reimbursement for. Tax treatment of fixed monthly meal allowances, meal allowances for working overtime, reimbursements for food and drinks for meetings, etc.

Big Education Ape Meal Reimbursement Rates 202521 Nutrition (CA, Reimbursements for lodging will be capped at $107 per. Allowable meal charges and reimbursements for daily subsistence.